The days of cheap car insurance are over, with the price of the average policy increasing by £27 to £549 and further rises to come, according to the AA.

The sharp increase brings to an end three years of premium declines and comes ahead of the government’s surprise hike in insurance premium tax. It kicks in in November and is expected to push up average premium prices by a further £18.

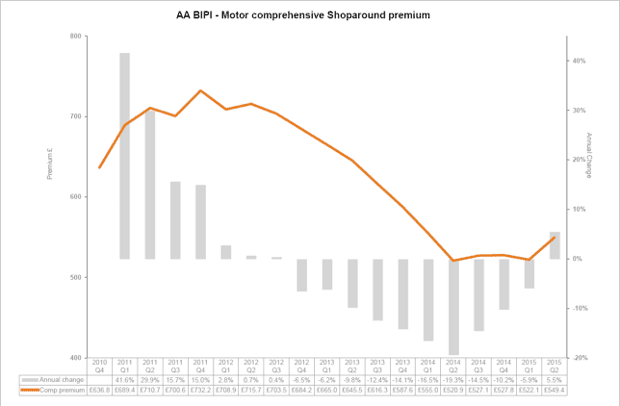

The AA’s British Insurance Premium Index, which has been running for 21 years, shows that the average quote for a typical comprehensive motor insurance policy climbed 5.2% to £549.46 between April and the end of June. Over the past 12 months, premiums have risen 5.5%.

Janet Connor, the managing director of AA Insurance, said: “The days of cheap car insurance premiums are over – price rises are inevitable. Insurers have been releasing their reserves to maintain their competitive edge to the point where this is no longer sustainable and we’re seeing premiums beginning to rise once more.”

On top of this comes the recently announced increase in insurance premium tax (IPT) of nearly 60%, from 6% to 9.5%, which means price rises are likely to be much sharper.

The tax hike will also add £5 to the average home insurance policy, which has just seen its first price rise in three years. While the average quote for a combined home and contents policy fell by 62p in the second quarter, standalone buildings and contents policies have shown small increases of 1.3% each. The AA expects this upward trend to continue. Flood Re, the new insurance schemedesigned to help those at highest risk of flooding obtain affordable insurance – which will be launched next year – is also likely to put pressure on premiums for all homeowners.

Connor said: “Increasing IPT will have unintended consequences. Not least is that more people are likely to shop around. This could lead to introductory offers drying up as insurers rethink their pricing. That will lead to a much sharper average increase than the tax rise suggests.

“I also fear that those on the lowest incomes may consider driving without cover, undoing the good work carried out to bring down the number of uninsured drivers. If that happens, it will also put more upward pressure on premiums.”

But she welcomed the increased focus on claims management companies, which encourage people to claim for injuries they have not suffered.

Owing to fierce competition between car insurers, premiums had been falling even though claims costs continued to rise, particularly for personal injuries such as whiplash. The number of injury claims reported has been increasing at about 10% a year since 2013, according to the AA.

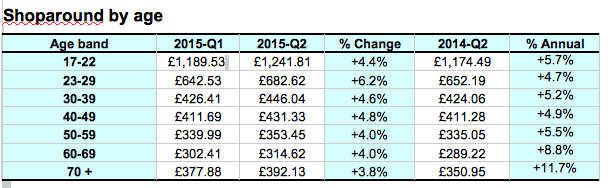

Younger drivers aged 23-29 have for the first time seen the sharpest premium rises in the second quarter, by 6.2% to an average of £682.62. Those aged 70 and above saw the lowest rise of 3.8% to £392.13.

The youngest drivers (aged 17-22) still have to fork out the most by far, with the average premium now at £1,241.81, up 4.4% over the past three months.

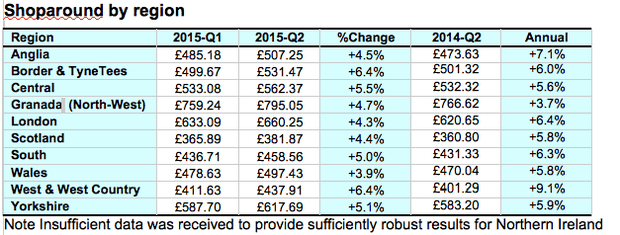

The AA figures also show that the north-west is the most expensive area, where the average premium increased by 4.7%, followed by London (4.3%) and Yorkshire (5.1%). Scotland remains the cheapest area to obtain motor insurance.

Barrie Cornes, an insurance analyst at Panmure Gordon, said: “The motor increases in particular will be seen as good news for the likes of esure, Admiral and Direct Line. That said, we would still urge caution given that the industry has been massively competitive for decades and has made an underwriting profit in so few years that we believe that it could practically apply for charitable status.”

Analysts at Barclays said: “We expect the momentum of pricing to continue in the second half of the year, with pricing likely to exceed claims inflation for the full year, leading to underlying margin improvement [for insurers] in 2016.”

No comments:

Post a Comment