|

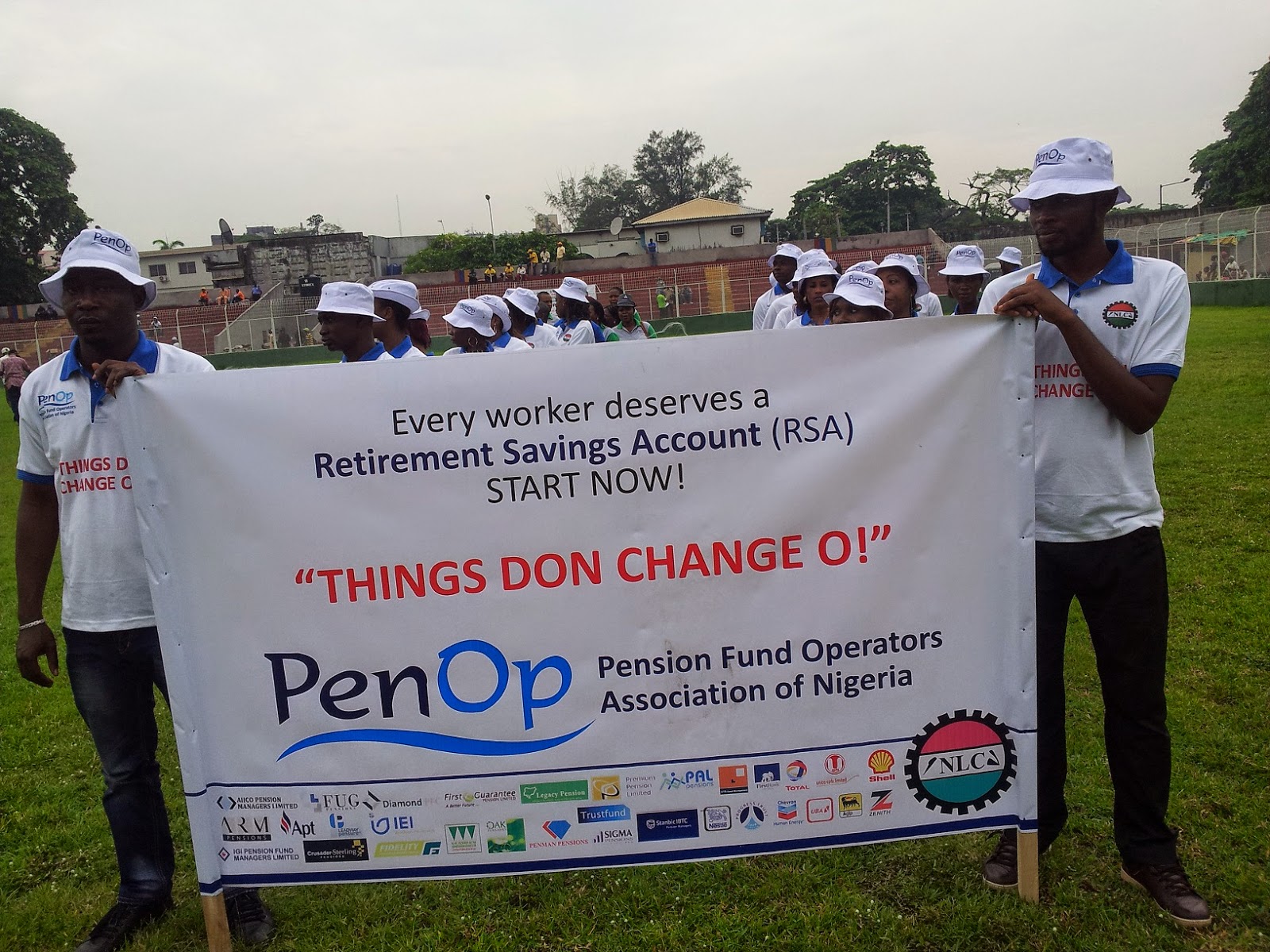

| PenOp members on parade |

Chuks Udo

Okonta

Pension Fund Operators Association of Nigeria

(PenOp), today at the workers’ day celebration urged workers in the country to leverage

the Contributory Pension Scheme (CPS) to secure their future.

Executive Secretary PenOp, Susan Oranye, who gave

the admonition at the workers’ parade in Lagos, which was attended by employees

of different organisations, said the contributory pension scheme remains one of

the best things to have happened in country in recent years, adding that the

scheme has instilled blighter future for workers.

She noted that the scheme was introduced to eradicate

the ugly sights where workers queue, cry and beg for their pension, stressing

that the new scheme is transparent, fully funded, safe and should be embraced by very worker.

She said: “PenOp

is here to honour and support Nigerian workers, which is what the workers’ day

is all about, the underlying concern for all pension fund administrators is for

the workers, to prepare them for when they would not be able to work again.

“We are here

to appreciate them for all they are doing to sustain the economy. We are also here to tell workers to think of

the future, by opening Retirement Savings Account (RSA).

“Workers are

indeed working hard, but they should also understand that after work they still

have bills to pay and how to pay these bills should be planned now that they

are in active service. We are calling on workers who are yet to embrace the contributory

pension scheme to do that now.”

She noted

that pension industry has done exceedingly well, given the level of awareness. She

said since the scheme started, about N24 .6 billion have been paid to over

84,000 retirees, stressing that there has never been any story. And that it is the

good testimony, which operators have being telling workers.

“This is a

new dispensation, it is not like the old scheme where people line up, cry and

beg for their money. The new scheme is really working and focused on workers.

It is transparent, fully funded and safe. Hence, every worker should embrace it,

as it provides decent living for retirees,” she said.

Susan noted

that the National Pension Commission (PenCom) and pension operators are working

hard to tackle the challenge on non remittance by some employers, stressing

that PenCom has come up with the names of defaulters and it is following them up.

She said PenOp

has also being having seminars, interactive sessions with employers to find out

why they are not remitting contributions.

“We have

being educating them on the need to understand that the fund is for their

employees and that they should also consider the system as a corporate social

responsibility which helps in boosting the morale of workers.

“When

employers provide secured future for their employees through pension, they would

be happy to give their best, which will raise the bottom-line of employers.

This event provides an opportunity for us to introduce workers to the pension

fund administrators. Workers in public and private sectors should comply with

this scheme which is one of the best means to secure the future of workers,”

she said.

Head, Risk and Compliance, Stanbic IBTC Pension Managers Idu Okwuosa, said the event provided an opportunity for PenOp to kick-starts it campaign, which theme is: Every Worker Deservers an RSA, adding that the operators are at the event to let workers know how important it is to have a retirement savings account.

She expressed

delight over the passage of the new pension Act by the National Assemby,

stressing that the Act will help enlarge the market scope of operators.

“We are

happy with the passage of the Act, which we have anticipated. The new Act would

help us expand our market. The new Act states that if an employer has three or

more workers, it is compulsory to open an account for them, but the old Act provided

for a minimum of five workers. Also the informal sector and voluntary contributions

are highlighted in the new Act. Another major plus in the new Act is the penalties

on embezzlement of pension fund. Going forward we would see more sanctions on defaulting

employers which is also provided for in the Act,” she said.

No comments:

Post a Comment